According to a study by the British Retail Consortium, retail crime cost UK retailers an estimated £1.5 billion in the year 2020-2021. This is why profit protection is important for UK retailers and other industries to reduce financial losses and maintain the stability of your business.

Running a business is more than just about generating profits. It also involves adhering to regulations and standards that govern the industry. Profit protection and compliance are crucial elements that can make or break a business.

Neglecting either of these can lead to significant financial losses and legal issues, making it essential for business owners to stay informed and take the necessary steps to protect their profits and ensure compliance.

What is Profit Protection?

Profit protection is a collection of methods and tools for reducing shrinkage, contributing significantly to retail losses. It is about determining the underlying cause of all losses without relying on guesswork.

It involves implementing strategies and processes to prevent financial losses and maximise profits. It typically covers the following areas:

- Financial management and reporting

- Internal controls and processes

- Risk management

- Compliance with laws and regulations

- Employee training and performance management

Common Causes of Business Profit Loss

Numerous types of business losses can decrease a company’s earnings. Here are the most common causes of failure.

Shrink

Shrink, also known as shrinkage, is any unaccounted-for loss of inventory. It is the difference between the expected inventory’s optimal sales profit and the profit earned from goods sold. Internal or external theft, fraud, waste, human error, inefficient processes, and vendor issues are all examples of shrinkage.

Internal Theft and Fraud

Internal theft and fraud refer to dishonest employees intentionally stealing from the company they work for. It is also known as employee theft. Internal theft can take many forms, but some of the most common are product theft, gift card scams, and drawer skimming.

External Theft and Fraud

External theft and fraud occur when someone from outside the organisation steals from the company on purpose. External theft can take many forms, including shoplifting and self-checkout fraud.

Waste/Spoilage

Items that are damaged and/or unsellable are considered waste or spoilage. Inefficient processes in the supply chain or at the order point are frequently held responsible. Damaged packaging and excess volume are all examples of common waste.

Importance of Loss Prevention

The overall objective of loss prevention is to contribute to the company’s profitability by reducing losses. The investment in loss prevention personnel, equipment, technology, and training should more than pay for itself by reducing issues such as inventory shrinkage.

However, loss prevention can have other advantages. For example, if the company can reduce the amount of stock that is missing, the information in its inventory management systems will more accurately reflect what’s in stock, lowering the chances that customers order products and then discover they’re out of stock. Accurate inventory information also helps in better business planning and financial reporting.

How to Build an Effective Loss Prevention Strategy

Typically, loss prevention is viewed as a business expense because it requires time, energy, and sometimes money. However, effective and efficient loss prevention strategies will protect your bottom line and help your business run more smoothly.

A lot can go into loss prevention programmes for businesses, depending on your industry and the size of the operation. However, there are some universal characteristics to consider. Here are guidelines for loss prevention strategies that are likely to benefit your business:

Conduct a risk assessment

Conducting a risk assessment is the first step in developing a plan for profit protection and loss prevention. This involves identifying the potential risks your business may face, such as theft, fraud, natural disasters, and market fluctuations. By identifying these risks, you can take steps to mitigate them and protect your business.

Train Employees

Employees who are properly informed of all hazards and trained to deal with them are more productive. They respond quickly to potential hazards and work diligently, resulting in increased profits by avoiding losses and increasing productivity.

If you don’t already have an employee training plan, now is the time to create one. Consider what you require from your employees and reciprocate with clear communication and respect. Employees, like any other group, respond better when they are treated well and with respect.

Use Data to Improve Training Procedure

Implementing programmes that promote accountability and hold employees at all levels to a certain level of performance is critical. Companies should create a workflow or a set of custom reports that allow managers and executives to collaborate and stay updated on the company’s procedural behaviours to stay organised.

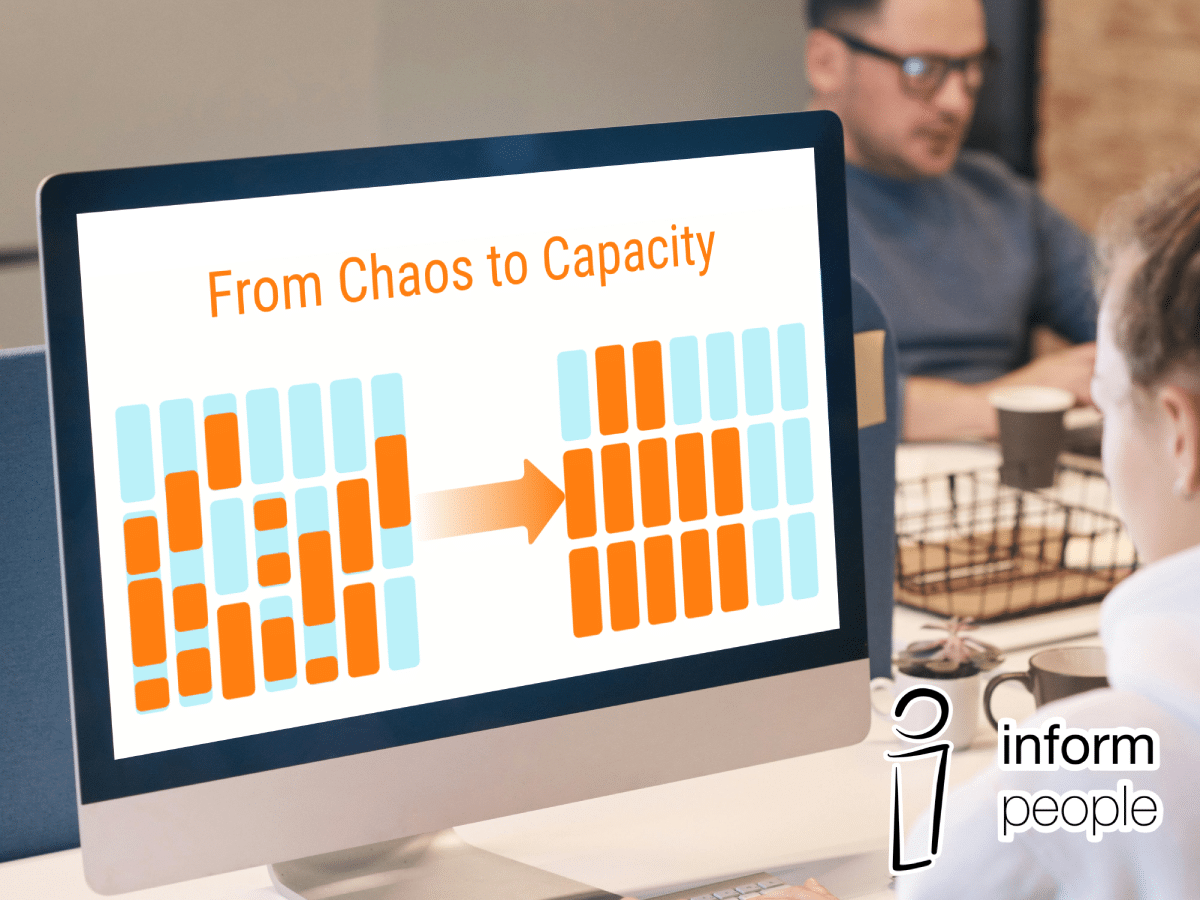

Boost Productivity

Labour costs are a major operating expense that can be reduced by increasing workforce productivity. Data can be combined with labour planning to create the most effective processes for optimising the productivity of all employees in an organisation.

The productivity equation has several components, all of which are focused on getting the most value out of a labour force. Ensuring that productivity measures do not open the door to profit-draining pitfalls such as overstaffing or understaffing is critical.

Focus on Learning

Provide opportunities to learn from near misses, accidents without losses, and accidents with losses to improve or develop new prevention strategies. Despite your best efforts, you cannot always control outcomes; what you do in those situations can help your business perform better in the future.

A solid, up-to-date business continuity plan should be a top priority. After all, you have precious little time to react when a cyber event, mechanical breakdown, or other disaster occurs, and a written plan can mean the difference between a total loss and rapid recovery.

Create Accountability by Clearly Communicating Policies

When developing a loss prevention strategy, effective communication is essential. One of the organisations’ most common challenges is a lack of alignment between operational and employee goals. Organisations that take the time to understand their employees’ goals can tailor incentive programmes to help drive the desired results.

On the other hand, implementing clear ramifications for employee activities that result in profit losses allows organisations to set clear standards and hold team members accountable. It is critical to recognise a fine line between optimising efficiency and appearing overly strict or overbearing to employees.

Continue to Refine the Loss Prevention ( LP) Strategy

Organisations will be able to track the progress of LP programmes over time as new areas for improvement are identified, and corrective actions are implemented. It’s helpful to think of loss prevention as a long-term project with frequent iterations as new data and insights become available.

Continue auditing loss prevention reports to maximise long-term profits and seek areas to fine-tune processes that will improve profit margins by reducing loss at all levels.

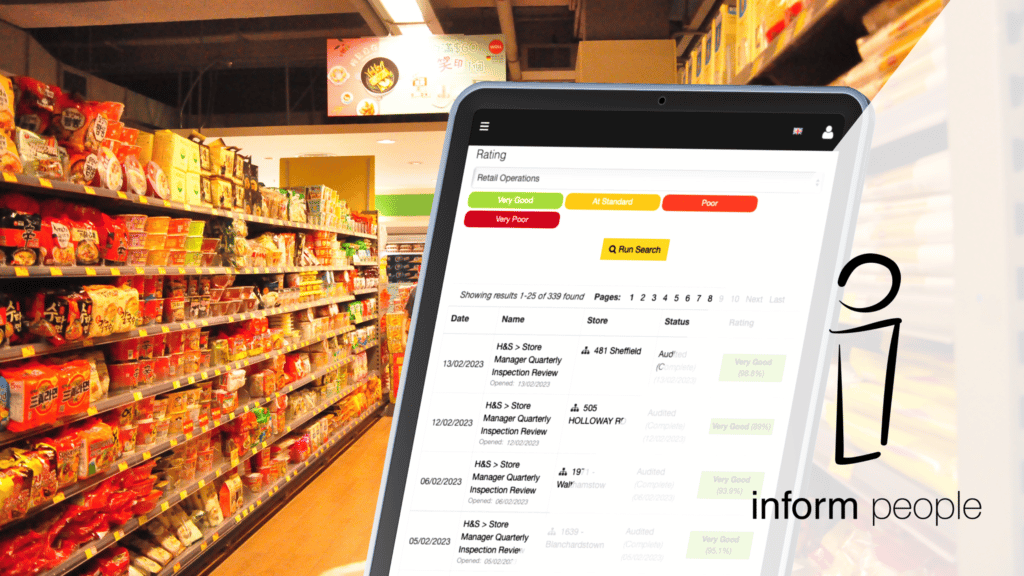

At Inform People, we understand the importance of maximising profits and minimising costs. That’s why we offer software designed to help you unlock the potential of your business and protect your profits. From compliance tracking and management to training employees, you can develop a customised strategy that meets the unique needs of your business.

Contact us to learn more about how we can help you unlock the potential of your business and protect your profits today.